Insider Tips - Weekly Stock Market Report - Week July 14, 2025

Weekly Insider Tips - July 14, 2025

Hey, it’s Mark here with another Insider Tips update. This past week has been a continuation of what’s been an incredible green market — and if you’ve been following the strategy, you’ve likely seen solid gains. We’ve been riding this upward wave for almost two months now, and while we know green streaks don’t last forever, it’s been a great time to push the accelerator. I dove into key market indicators, chart setups, individual stock performance, and trends that continue to shape our trading decisions. Plus, I gave a sneak peek of the exciting Juice Lever Strategy I'll be unveiling at the end of July, which helps generate income no matter which way the market goes. Lots to be excited about — let’s break it all down.

📈 Technical Market Overview

We’re in a green market across the board, and that’s your cue to take action. We’ve had around two months of consistent bullish activity, and while that can shift quickly, our tools and market timing help us stay ahead. The 4 green lights are on, and when that happens, I like to hit the gas.

-

NASDAQ: Just printed a golden cross, confirming bullish momentum. We're at all-time highs, albeit with slight faltering.

-

S&P 500 (SPY): Same story — hitting new highs and maintaining a solid uptrend.

-

Dow Jones: Not quite there yet, but approaching a golden cross. If the Fed signals dovish policy — either through rate cuts or neutral stance — we could see the Dow target 45,000.

-

Volatility is calming down, which typically fuels a slow market melt-up.

💹 Bitcoin & Crypto-Related Trends

Bitcoin broke out and hit an all-time high of $118,000 USD per coin — and I believe it’s just getting started. That kind of movement supports crypto-adjacent stocks and ETFs like:

-

IBIT (BlackRock’s Bitcoin ETF) – tracking well with Bitcoin’s surge.

-

Robinhood (HOOD) – also at an all-time high, partially riding the crypto wave due to trading exposure.

🧠 Individual Stock Breakdown

Here’s what I’m watching and trading:

-

NVIDIA (NVDA): Picture-perfect chart. Strong relative strength, bullish golden cross, and new all-time highs. Still running.

-

MicroStrategy (MSTR): Hit resistance around $438, pulled back to $430. Likely to test the $422 gap, but if it holds, could target $543 again — possibly even higher.

-

Palantir (PLTR): At a late-stage base — risky but strong. It’s chugging upward with support from government contracts.

-

Apple (AAPL): Stabilizing after a pullback. Looks to be starting its next move higher.

-

Tesla (TSLA): One of the laggards. Sitting below its 50- and 200-day moving averages, and stuck in a wide sideways range. Earnings are coming up, but expectations are low — which sometimes leads to surprise upside.

-

Broadcom (AVGO) & AMD: Riding the coattails of NVIDIA and the AI chip wave. AMD, which I called around $95, is now around $140 — a great bounce-back.

-

Shopify (SHOP), Amazon (AMZN), and Meta (META): All strong performers in this melt-up environment. Great picks in the current trend.

📊 Sector Strength

Top-performing industry groups (out of 197 total) show that sector leadership is clear. Leading groups include:

-

Steel

-

Auto/Truck Manufacturing

-

Semiconductors and tech-related industries

These sectors are pulling weight, and many stocks within them are also breaking out or forming strong bases. When the group chart looks good, individual stocks tend to follow.

🧪 Key Takeaways

-

✅ Green market = time to press the gas. Use market timing to enter early.

-

💡 Golden crosses across major indices and key stocks = bullish confirmation.

-

🪙 Crypto surge is boosting related stocks like HOOD and IBIT.

-

⚠️ Some big names like Tesla are underperforming despite the green market.

-

🔁 Use this time to collect income, especially from stocks going sideways.

-

🧠 Keep a close eye on sector rotation — top-performing sectors tend to deliver the best trades.

📅 Upcoming Event – Juice Lever Strategy Webinar

Don’t forget! I’ll be hosting a live webinar July 23rd, 8PM (ET) on YouTube to unveil the Juice Lever Strategy — a brand-new way to generate income in up, down, or sideways markets. It’s a smarter way to play both sides and collect consistent “juice.” No signup needed — just mark your calendar, bring your notes or a Red Bull, and join me live.

🔚 Final Thoughts

This has been a fantastic stretch for the market, and if you’ve been following along, you’ve likely been rewarded. From the rise in Bitcoin to breakouts in tech, semiconductors, and select industrials, we’re seeing opportunity everywhere. But remember — green markets don’t last forever. That’s why we stay vigilant, use our tools, and lean into cash flow strategies like the ones I teach.

✅ Quick Summary

We’re in a strong green market. Key indexes and stocks like NVIDIA and Palantir are booming. Bitcoin just broke records. Tesla is lagging, but most stocks are heading higher. It’s a great time to be collecting income and riding the wave — and I can’t wait to share more about the Juice Lever Strategy later this September.

Current Market Condition:

We’re currently in a strong green market, which has been running for nearly two months now — a rare and powerful trend. With all four green lights showing, it’s a signal to step on the gas and take advantage of upward momentum. While green markets often start off feeling uncertain, they usually deliver strong gains for those who act early. This is why market timing is so crucial — getting in near the beginning gives you the best chance to ride the wave. The major indexes like the NASDAQ, S&P 500, and Dow are showing bullish patterns, with golden crosses forming or already in place, signaling continued strength. While this kind of melt-up won’t last forever, it’s been a great period for collecting income and participating in broad market gains.

Stock Tip of the Week:

📈 How I Can Make $2,200 in 10 Days With This Stock!

Shopify (SHOP) is exploding — and in this video, I break down exactly how I plan to generate $2,200 in just 10 days using a covered call strategy. If you're into cash flow, smart options trading, and want a real example of how to turn market momentum into income, this is one you don't want to miss.

💰 Cash-Secured Puts vs. Covered Calls – Which Strategy Is Better for Income?

In this video, I break down the pros and cons of cash-secured puts and covered calls — two powerful strategies for generating income. Which one is better? It depends on your goals and market outlook. I’ll walk you through when to use each, how they work, and how to decide what’s right for your portfolio. Don’t miss it!

🚀 Announcing: The Juice Lever Strategy – The Next Evolution in Options Trading

I’m excited to unveil my newest course: The JuiceLever Strategy — a powerful way to generate income whether the market goes up, down, or sideways. The real magic? It’s all in the Trade Adjustments. This is the next step in smarter, more flexible income trading.

📅 More details coming soon about the July 23rd LIVE Webinar — mark your calendars!

⏰ Just a Reminder – Our 3-Day Income Weekend Is Filling Up Fast!

Last week, I shared something BIG—and now that the word is out, spots are already being claimed…

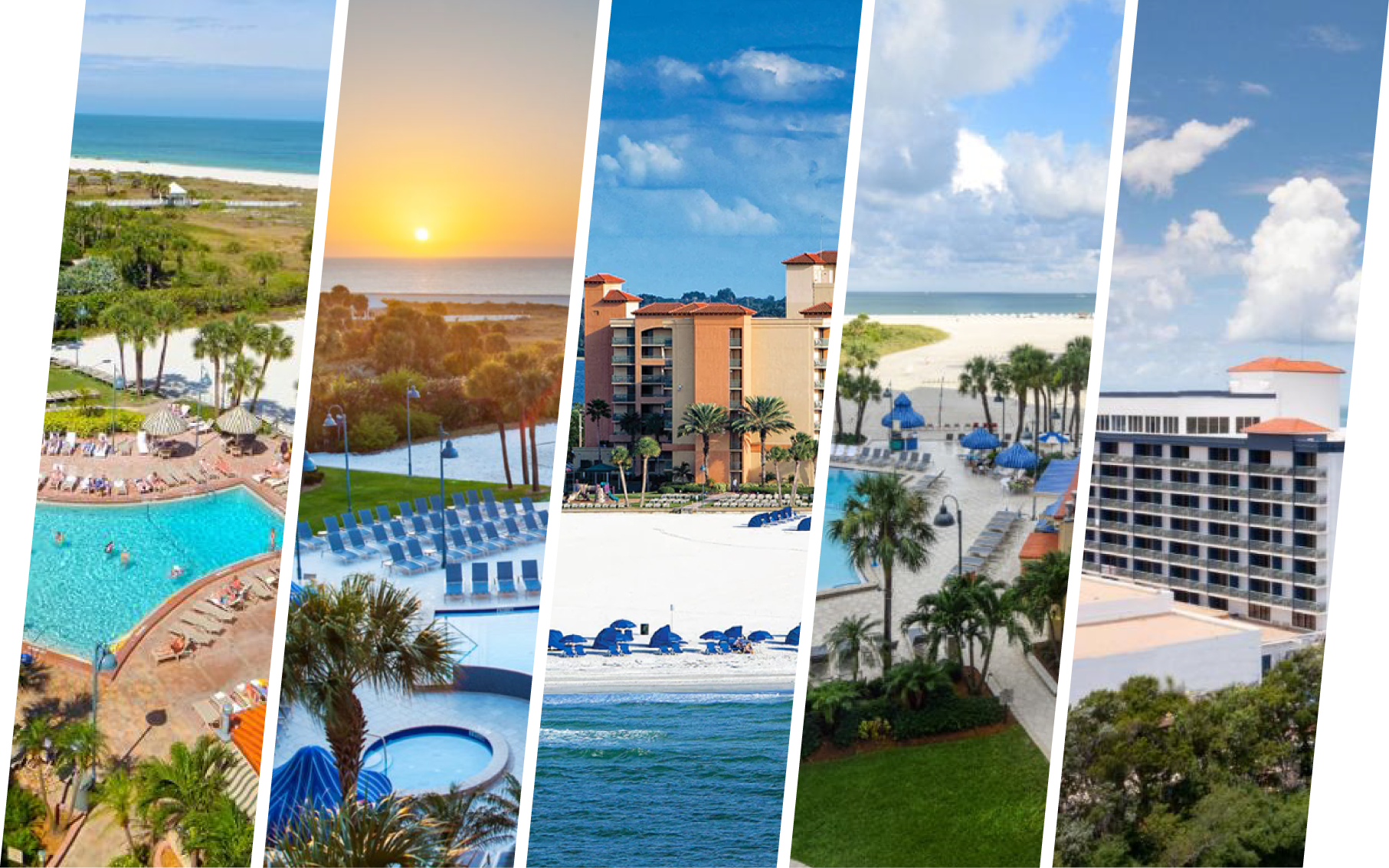

🎉 The 3-Day Income Strategy Weekend is happening September 26–28 in beautiful Clearwater Beach, FL

🌊 Learn advanced income strategies, live trading setups, and my full Cash Flow Machine system—all in one unforgettable weekend.

🤝 Network with high-level investors and get hands-on with what’s working right now.

🚨 Early Bird Pricing is still available—but it won’t be for long. If this event is on your radar, now’s the time to lock it in.

✅ Grab your seat here »

Let’s squeeze the juice together—live in Clearwater!